Financial Viability: The Challenges of Living in Two Worlds

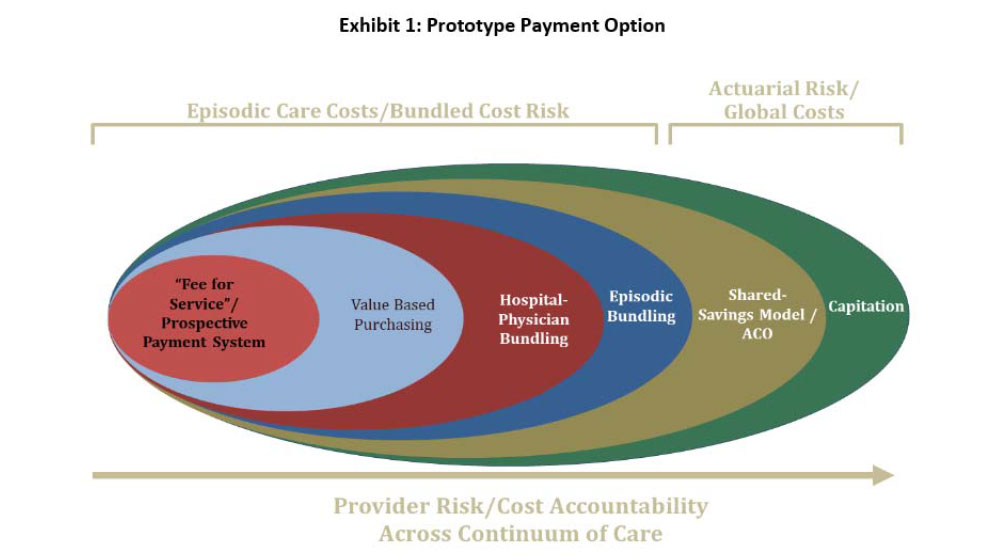

“If they just gave us a clear set of rules, we would be able to figure out what to do!” This lament has never been more true for hospital board leaders, executives, and physicians. We often hear that the industry is moving from paying for volume to paying for value. We know more financial risks will be shifted to providers (see Exhibit 1). We know payment cuts are underway; insurers are creating payment incentives for patients to obtain care in non‐hospital settings; and more and more experiments are taking place where primary care physicians are provided with substantial payment incentives for better managing (reducing the amount of) care for their most acutely and chronically ill patients—that 10 percent of patients who consume over 50 percent of the dollars.

While there has been enormous focus on—and political discourse around—those aspects of federal healthcare reform related to expanding access to care, the revolution in payment approaches already taking place will likely have a more profound long‐term impact on the industry. Many of these payment changes are led by Medicare (is our new national adage really, “When Medicare sneezes; the healthcare industry gets a cold?”), but Blue Cross and commercial insurers are also actively experimenting with new payment approaches and incentives for providers and patients. States as diverse as Vermont and California are considering legislation to create single‐payer systems, and Massachusetts is considering moving toward a “global payment system” (networks of hospitals, physicians, and/or other providers would be paid based upon the numbers of persons assigned to them for care, not for the specific services rendered).

Uncertainties about future payment approaches and levels of payment are myriad. Who will be the next president, and what steps will he take to further or to repeal federal health reform? What will the Supreme Court determine about the “mandate” question? Will the deficit conscious Congress once again stave off the provisions in a 1997 law that would reduce Medicare payments to physicians by an average of 30 percent in 2012? What will the SuperCommittee recommend?

In 2010, the National Commission on Fiscal Responsibility and Reform (the so‐called “Deficit Reduction Committee”) wrote, in the preamble to its final report:

“We spent the past eight months studying the same cold, hard facts. Together, we have reached these unavoidable conclusions: The problem is real. The solution will be painful. There is no easy way out. Everything must be on the table. And Washington must lead.”1

While the Commission was describing efforts to reduce the overall federal deficit, the same words describe healthcare costs. Make no mistake, the payment reforms underway all have one primary goal: to reduce healthcare costs. Packaging this as “the value equation” may sound better than calling it “cutting payments,” but the value equation is simple math: quality divided by cost. Quality may improve marginally, but the real increase in value—at least in the short run—will be created by substantially cutting the denominator (cost) through a combination of utilization reductions and payment changes. For example, under the October 2011 announcement of the final rule related to Medicare accountable care organizations (ACOs), “shared savings bonus payments” to participating ACOs would be paid if and only if their actual spending were below the applicable benchmark. 2

Actions for the Board

No one expects board members to know the details of the myriad payment approaches outlined in Exhibit 1. However, the board can and should play a vital role in helping to ensure that the hospital or system remains financially viable through what could be a decade‐long transition period.

1. Do scenario planning with physician leaders, the executive team, and the board to agree on the most likely future payment changes and the “wild cards”—or game‐changing approaches to payment—that your hospital and physicians will face. Future uncertainties cause anxiety. Unfortunately, they also cause conflicts when different constituencies hold differing assumptions (or sometimes wishes) about how and when the market will change.

One extremely useful framework for your discussions, developed by The Chartis Group, comprises three stages of market evolution:3

- Stage I: Insurance Reform: where underfunded universal coverage is the norm. This stage is characterized by fee‐for‐service payments prevailing, but insurance reforms driving increased access and reduced funding. This describes many of today’s markets.

- Stage II: Payment Reform: where changes such as bundled payments or payments linked to outcomes characterize the market. Of course, this stage requires that the hospital or system have in place effective care management and network management capabilities.

- Stage III: Delivery System Reform: characterized by care management and population-based risks having been shifted to providers in models such as ACOs or global payments. In Stage III, the hospital would need access to a robust infrastructure to manage the health of a population of community residents—a far cry from today’s capabilities.

2. Understand the nature and magnitude of the financial risks that would be borne by your hospital or system under each type of payment arrangement, so that the organization can make an informed decision about whether and how to proceed. Determine whether you want to be a market enactor (bearing the greater associated risks and potentially achieving greater returns of this stance), hedge your bets, or “wait and see” how the market evolves. Should your hospital participate as one of several partners in a broad‐based regional ACO, become the hub of an ACO, or be a vendor to other ACOs? What would be the magnitude of the required ACO investment to obtain the care management and population management infrastructure you would need? Is it closer to the $1.8 million investment CMS estimates would be required to become an ACO or the $11.6 to $26.1 million the American Hospital Association‐sponsored independent study identified?4

3. Set a goal to at least break even on Medicare within 18 months. This does not sound very inspirational, but it is necessary. For most hospitals, Medicare is the single biggest payer. Average hospital total Medicare margins have been negative (−5 percent in 2009 and projected to reach −7 percent in 2011).5 It is not feasible to “lose money on every case and make it up on volume.” Getting to at least break even on Medicare is not just sound financial policy in the short run; it will provide an opportunity for the hospital, its physicians, and other caregivers to work collaborative to deliver care within a fixed price—as will be required under bundled payments, episode of care payments, and other payment approaches.

4. Be sure that the hospital has conducted an objective self‐assessment of its readiness for new risk‐based payment approaches. While the timing and the exact form of payment changes is uncertain, it is better to be proactive than to scramble after the fact. Numerous organizations, from alliances such as Premier, Inc. to accounting and consulting firms, offer tools to help hospitals or health systems assess their readiness for the upcoming payment changes. In general, these assessments focus on the degree to which you demonstrate the desired attributes of an integrated healthcare delivery system: system integration and a seamless continuum; aligned physicians and vehicles in place for joint contracting with physicians; chronic care management approaches/use of evidence‐based medicine; a robust electronic health record that extends into physician offices; demonstrated high quality and satisfaction; demonstrated cost‐effectiveness; a strong corporate compliance program; and transparency on costs and quality.

In summary, we should assume that we will be living in at least two worlds of payment over the next decade. Even if all public programs changed simultaneously, it would likely take years for all commercial insurers to follow suit. Understanding the risks and success factors for these new approaches, and translating these into practical and financially viable strategies, will separate the market winners from the losers. With change, some always prevail; now is the time to make sure your organization becomes one of the winners.

The Governance Institute BoardRoom Press – December 2011

Marian C. Jennings, President – M. Jennings Consulting, Inc.

› Download PDF

2 American Hospital Association, AHA Special Bulletin, ACO Final Rule Released, October 20, 2011.

3 The Chartis Group, Improving Performance and Building Capabilities During Turbulent Times, June 2010. See www.chartisgroup.com/files/pdfs/chartis_operations_june10.pdf.

4 American Hospital Association, AHA Special Bulletin, ACO Final Rule Released, October 20, 2011.

5 MedPAC, Report to the Congress: Medicare Payment Policy, March 2011. See http://medpac.gov/documents/Mar11_EntireReport.pdf.