Importance of Cash for Long‐Term Financial Strength

The June BoardRoom Press article on why bond ratings matter identified five tangible benefits to hospitals and systems that achieve and maintain higher bond ratings. These benefits include enjoying lower financing costs, ensuring ongoing access to capital and more financing alternatives, being subject to fewer and/or less restrictive debt covenants, having greater financial flexibility in the event of short‐term financial difficulties, and being able to measure the organization against the “best” quality financial practices in the nation. An organization’s cash position will determine the degree to which it can enjoy these five benefits, both in the short‐ and long‐term.

Bond Ratings and Cash Measures

Traditionally, the following have been the key measures of financial strength that boards and management have focused on and widely used to achieve the performance levels of a targeted bond rating:

- Operating and total margins, indicators that reflect the ability of the organization to sustain itself and generate positive cash flow. These are income statement measures.

- The debt service coverage ratio, an indicator of the ability of the organization to generate sufficient cash to repay its debt. This is a cash flow measure and is obviously of great importance to creditors.

- The capitalization ratio, an indicator of what portion of the organization’s asset base has been financed by debt rather than equity (internally generated funds or philanthropy). This is a balance sheet measure.

These are still critical determinants of financial strength. However, organizations should also monitor their performance against the following additional indicators of financial strength and stability. These relate to the organization’s cash position and provide a sense of the financial “cushion” the organization enjoys and, as such, assure potential lenders that the organization could maintain its financial integrity in the event of a short‐term financial crisis. The two key indicators are:

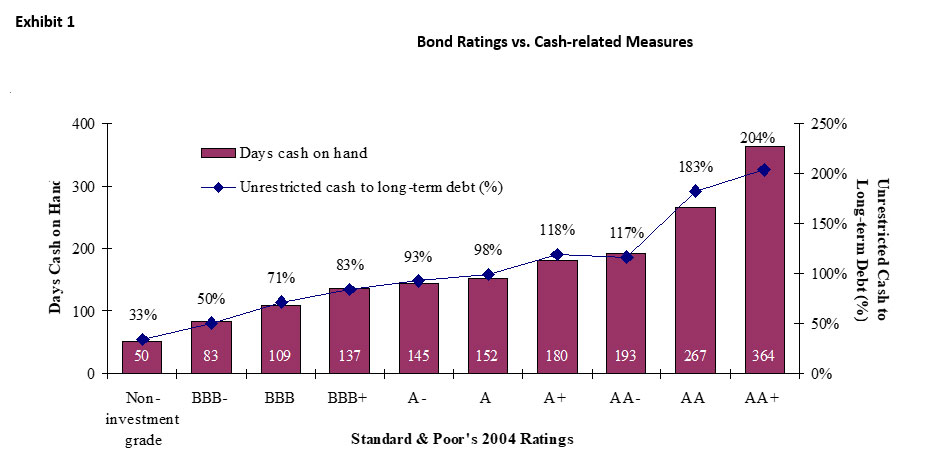

- Days cash on hand, a measure of the days that the organization could continue to function were it relying solely on the unrestricted cash it has on hand today. The ratio is defined as: days cash on hand = (unrestricted cash and investments x 365)/(total operating expenses – depreciation and amortization expenses). As indicated in the bar graph in Exhibit 1, which presents data from Standard & Poor’s ratings of healthcare organizations in 2004, a direct correlation exists between higher bond ratings and the (median) level of days cash. For example, the median days cash on hand for hospitals and health systems with ratings in the AA categories ranged from slightly over six months of cash to approximately one year’s cash. On the other hand, those in the BBB categories had (median) levels of cash ranging between 83 days and 137 days. Those credits considered below investment grade had a median of only seven weeks of cash.A review of the trends between 1999 and 2004 reveals that days cash on hand by rating category have remained relatively stable over the six‐year period.

- Cash to debt ratio, a measure of the ability of the organization to repay its debt with cash it has available today. This ratio is defined as: (unrestricted cash and investments)/(long‐term debt + short term debt). As indicated in the line graph in Exhibit 1, healthcare organizations with a rating of A or better have more than enough unrestricted cash on hand today to repay their debt obligations. The highest‐rated organizations—those with AA or AA+ ratings—have significantly more cash than total debt. These extremely strong cash levels have helped some of these organizations retain their bond rating levels in a year when their operating performance has otherwise slipped.

Building Up Unrestricted Cash

Through its finance committee, the board should establish clear targets for both days cash on hand and cash‐to debt as part of a long‐term strategic financial plan. Such a plan should lay out sources and uses of funds over the next three to five years and articulate targets for all key financial indicators. The tips outlined in Exhibit 2 should help to focus the board’s activities in this effort.

Exhibit 2

Tips to Strengthen Cash Positions

- Establish five-year targets for days cash on hand and cash-to-debt ratios consistent with your targeted bond rating or other financial benchmarks.

- Develop a long-term strategic financial plan, balancing sources and uses of funds.

- Determine your annual and five-year financial capability – or how much the organization can afford to invest in capital projects – only after having set aside the necessary funds to increase cash/investments to targeted levels.

- Never accept a break-even operating margin. Target operating margins (before investment income) in at least the 2–3% range (preferably even higher).

- Make philanthropy a greater focus and recognize that this is a long-term relationship-building endeavor.

- Use financial criteria in ranking capital projects, since when you convert your organization’s cash into a piece of equipment or fund facility renovations, you must ensure that you continue to generate a positive financial return on the new form of the “asset.”

First, whenever the organization is planning for a major capital project for facilities modernization or expansion, building up cash should be considered in and of itself a top strategic and financial priority. Achieving the desired cash position will require that the organization determine its financial capability—or the ability to undertake capital projects—only after subtracting the amount of cash that must be put aside each year to strengthen its cash/investment position.

Second, set aggressive but achievable targets for operating margin, an important source of internally generated cash. Despite the collision course on which payment pressures and cost increases are headed, hospitals and systems must generate a positive operating margin to ensure long‐term viability.

Third, develop a long‐term strategy for increasing philanthropy. While philanthropy ranks today as the number six source of capital funding, a recent survey of chief financial officers of hospitals and systems1 revealed that they expect this source to move up to number three in the future, just behind operating cash flow and tax‐exempt bonds.

Finally, use return on investment criteria to review major capital expenditures, recognizing that when the organization converts income‐producing investments into healthcare‐related assets (plant and equipment), it is essential that the new equipment, technology, and facilities generate positive cash flow and a long‐term return.

Using these tips to build cash will allow the organization not only to enjoy the benefits of a stronger credit rating, but also to reduce its borrowing requirements by being able to fund a larger portion of its capital projects from cash.

Importance of Cash for Long‐Term Financial Strength – August 2005

Marian C. Jennings, President – M. Jennings Consulting, Inc.

› Download PDF

1 Healthcare Financial Management Association, Financing the Future Report 4, How are Hospitals Financing the Future? The Future of Capital Access, May 2004.